Microfinance lenders urge improvements in governance for lending

Microfinance lenders urge improvements in governance for lending

Improvements in corporate governance and risk management are believed to support microfinance institutions in Viet Nam in catering to the financial needs of micro-enterprises and low-income groups.

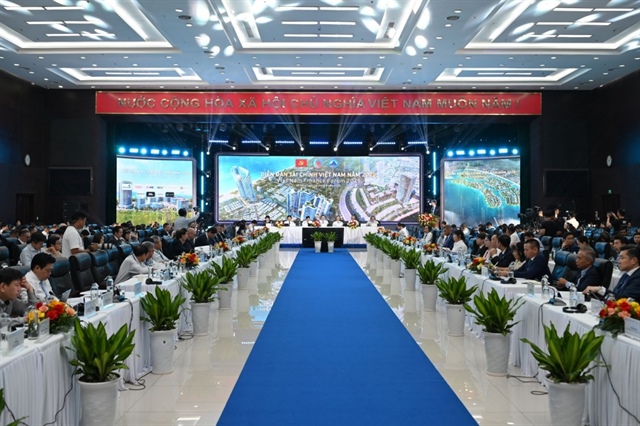

Dozens of board members and senior executives of Vietnamese microfinance institutions gathered in Can Tho on January 1 for a two-day workshop to address the common challenges they faced and develop an action plan for improvements.

Globally, regulators and investors have been supporting company efforts to demonstrate better governance, such as having a robust board, accountable senior management, effective internal control and risk management practices.

“IFC (International Finance Corporation) believes supporting Vietnamese microfinance institutions in strengthening their corporate governance practices will boost their capacity to provide better financial services and expand lending,” said Kyle Kelhofer, IFC Country Manager for Viet Nam, Cambodia and Laos.

“This will ensure sustainable growth for the institutions and benefit their key clients – millions of micro-entrepreneurs, primarily women, and low-income households, contributing to poverty reduction in the country,” Kyle said.

According to IFC studies, only one in five adults in Viet Nam have access to formal financial services, while only 8 per cent of them have savings in formal institutions.

Mircofinance lenders play a critical role in providing financial services to the low-income population, serving an estimated 10 million people, many of whom are women and the poor.

“Viet Nam’s microfinance sector is evolving with many small, non-profit operators hoping to transition into bigger, commercial-oriented entities,” said Nguyen Thi Tuyet Mai, managing director of Viet Nam Microfinance Working Group.

“Implementing corporate governance reforms to enhance efficiency, transparency and risk management will be paramount to their successful transitions,” Mai said.

The workshop was conducted by IFC, a member of the World Bank Group, in partnership with Citi Foundation and Viet Nam Microfinance Working Group.

This initiative was part of IFC’s Viet Nam Microfinance Programme – supported by the State Secretariat for Economic Affairs of Switzerland – with the aim of strengthening industry capacity and transparency as well as boosting microfinance institutions’ ability to increase sustainable and responsible financial access.