Close-up of PetroVietnam’s three major IPOs in 2017

Close-up of PetroVietnam’s three major IPOs in 2017

The IPOs of three major oil and gas companies—Binh Son Refining and Petrochemical Company (BSR), Vietnam Oil Corporation (PV Oil), and PetroVietnam Power Corporation (PV Power)—are expected to be the “blockbusters” on the stock market in the last quarter of the year.

What makes BSR, PVOIL and PV POWER so attractive?

Of the state-owned enterprises set to be equitised in the fourth quarter of 2017, perhaps the IPO of Binh Son Refining Petrochemical One Member Company Limited (BSR) has attracted the most attention from the public.

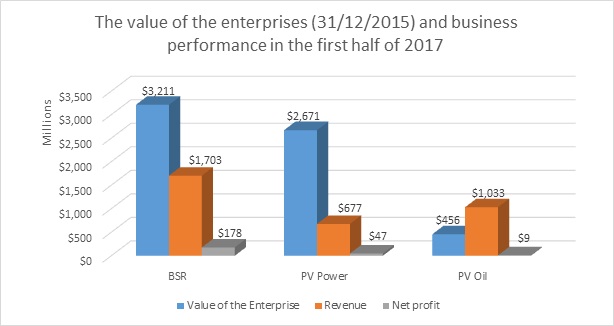

By the end of May 2017, the Ministry of Industry and Trade announced that the value of the enterprise as of December 21, 2015 was VND72.88 trillion, equivalent to $3.2 billion. Of this, the value of state capital was more than VND44.934 trillion ($1.98 billion).

BSR is an affiliate of Vietnam's oil and gas group PetroVietnam, which is directly in charge of the management and operation of Dung Quat Refinery—the country’s first oil refinery. The refinery was built to serve the localisation of petrochemical products supply. It was inaugurated in 2011 with a total investment of $3.05 billion and is currently able to satisfy 30 per cent of domestic petroleum demand.

In 2015 and 2016, BSR’s after-tax profit reached VND6.707 trillion ($295.5 million) and VND4.492 trillion ($197.89 million), respectively. In addition, the return on equity (ROE) of the firm in these two years was 21 and 14 per cent.

According to the executives, in the first eight months of 2017, BSR recorded strong business results with an after-tax profit of VND4.002 billion ($176.3 million), close to that of the whole year of 2016.

Along with BSR, another PetroVietnam affiliate PV Power is also waiting for its IPO in December 2017. The value of the enterprise as of December 31, 2015 was determined at VND60.623 trillion ($2.67 billion), The chartered capital was estimated at VND21.774 trillion ($959.2 million), while the owner’s equity was VND33.550 trillion ($1.48 billion).

After being established in May 2007, with 100 per cent of chartered capital invested by PetroVietnam, PV Power gradually became one of the three major pillars of the Vietnamese electricity industry, as it is responsible for managing and operating four gas-fired, one thermal, and one coal power plants as well as three hydro power plants with a total designed capacity of 4,208MW.

The corporation’s annual electricity output is about 21 billion KWh, accounting for 13-15 per cent of the national electricity output. Gas power is also a major field for PV Power’s business.

After equitisation, along with maintaining efficiency and improving the capacity of existing plants, PV Power will continue to invest in further development. It looks forward to increasing the capacity of its plants by 118.65 per cent to reach 9,201MW by 2020.

Besides, by 2016, total capacity is forecast to reach 10,650MW, equivalent to an increase of 160 per cent compared to the end of 2015. Meanwhile, investment will mainly focus on the gas power business.

By 2026, gas fired power plants are expected to be the dominant generators and occupy at least 86 per cent of total capacity. In the short term, PV Power has been assigned to invest in large-scale gas projects, such as Nhon Trach 3 (NT3), Nhon Trach 4 (NT4), and Kien Giang Power Center.

The other major oil and gas company awaiting its IPO in the last few months is Vietnam Oil Corporation (PV Oil). The value of the enterprise as of December 31, 2015 was VND10.342 trillion ($455.6 million).

Established in June 2008 after the merger of PetroVietnam Trading Corporation (Petechim) and PetroVietnam Oil Processing & Distribution Company (PDC), PV Oil is now the second largest petroleum retailer in Vietnam.

It holds 20-22 per cent of the market share, second only to Vietnam Petroleum Corporation (Petrolimex). Gasoline distribution is currently the corporation’s largest revenue source, accounting for 75 per cent of the total revenue.

Besides the domestic market, PV Oil has expanded to Laos, Singapore, and Cambodia. It is known that in the next five years, PV Oil’s management board will spend hundreds of millions of dollars to raise the number of sales points across the country to 1,500, three times more than today, to achieve the target 35 per cent market share by 2022.

Regarding PV Oil’s business performance, in 2016, the corporation achieved VND39 trillion ($1.72 billion) in total revenue and VND626 billion ($27.6 million) in pre-tax profit. In the first six months of 2017, PV Oil is expected to yield VND23.439 trillion ($1.03 billion) in total revenue and a pre-tax profit of VND200 billion ($8.8 million).

In addition to the scale of business and operations, investors need to consider aspects generally not featured in reviews or analyses of enterprises.

For example, PV Power faces serious issues. Despite the continuous growth in revenue over the years, profit tends to shrink while pressure from debt obligations keeps mounting. In 2016, PV Power recorded a pre-tax profit of only VND1.695 trillion ($74.67 million), much lower than the VND3 trillion ($132.2 million) earned in 2014-2015.

At the end of 2016, PV Power’s liabilities have amounted to VND42.935 trillion ($1.89 billion), making up 61.57 per cent of the total capital. Of this, borrowings accounted for VND30.363 trillion ($1.34 billion), and mainly comprised of long-term USD-denominated debts with floating interest rates.

In 2016, PV Power had to put aside VND6.857 trillion ($302.1 million) to pay principal and interest on older debts. Another VND8.213 trillion ($361.8 million) was also reported in 2015. Large debts, on the one hand, will put heavy pressure on cash flows as the net cash flow for debt repayment is higher than the cash flow raised by business activities.

On the other hand, the firm allow fluctuations in interest and exchange rates to exert considerable impact on profit. As demand for input materials remains low while exchange and interest rates are pegged stable, if PV Power fails to improve its situation, unexpected fluctuations can strongly affect business results.

Meanwhile, despite being an enterprise with a large stock of assets and capital as well as operating in key areas, so far, information on PV Oil is very limited. Therefore, it is quite difficult for investors to fully evaluate the quality of the corporation’s assets and capital.

Statistics on revenue, return on assets, market share, and network scale also showed a fairly big gap between PV Oil and its current direct competitor Petrolimex. Comprising of eight subsidiaries, 30 member units, ten associate companies, and seven financial investment companies, the cumbersome organisational structure of the PV Oil is also a matter of concern for investors.

The attractive proportion of shares for sale

One of the factors that make the IPOs more attractive is the amount of shares offered for sale. Accordingly, the government has announced its intention to reduce ownership in BSR, PV Oil, and PV Power below the controlling rate, and listing these companies on the stock market right after the equitisation.

Specifically, according to PV Oil’s equitisation plan, which is currently waiting for approval, the state will retain only 35 per cent of the capital and offer approximately 65 per cent for sale. Of this, 50 per cent will be offered to strategic investors and 15 per cent will be sold via the IPO.

At PV Power’s IPO next December, the corporation plans to offer a 20 per cent stake to investors and offer an additional 29 per cent to strategic investors. The state will retain 51 per cent of the capital before executing its divestment plan sell further stakes in 2019-2020.

As stated in BSR’s equitisation plan submitted to the government, the state will only hold 51 per cent or less in the corporation.

From strategic investors’ perspective, a high return on equity will enable investors to buy large amounts of shares and participate in the management and operation of the company, even move towards dominant control over the largest energy corporations in Vietnam.

For individual investors, the attractiveness of these equitisation plans largely lies in the expectations that reducing state control will help businesses become more active in the private sector, while making the most of their existing assets and capabilities to improve efficiency.

The stock market has witnessed positive growth since the beginning of the year, which is reflected exclusively by improvements in performance and liquidity as well as the fact that the derivatives market has been put into operation.

This has facilitated the auction of equitised enterprises as well as the putting of these equitisation plans in practice. However, there is not much time left in 2017. Hence, greater efforts and initiatives from these enterprises are required to complete the plans in line with the roadmap.

After numerous delays and suspensions, the market expects to see “some blockbusters” explode in the second half of the year, providing investors with more quality products.

However, in order to achieve successful deals, information on business performance, long-term development strategies, as well as offering prices are certainly need to be made easily accessible by enterprises. This is inevitably a prerequisite condition to generate confidence in investors and enhance market appeal.