New regulation feared to put cross-ownership network in a maze

New regulation feared to put cross-ownership network in a maze

Under the government’s Resolution No. 15, state owned commercial banks can buy the stakes of finance companies and banks to be sold by State owned enterprises (SOEs) during their capital withdrawal process.

SOEs have been urged by the government to speed up the process of withdrawing the capital they invested before in the businesses in non-core business fields.

The process has been going slowly because, as explained by the SOEs, it is very difficult to find the investors who accept to buy stakes.

The government, in an effort to provide more “buyers” to the SOEs, has decided that state owned banks can buy the stakes of finance companies and banks to be sold by the SOEs.

The new regulation obviously would help SOEs sell their stakes to fulfill the commitments on withdrawing capital from non-core business fields to gather their strength on their main jobs.

However, experts have warned that once state owned banks “take on” more bank stakes, this would make the cross-ownership, a big problem of the banking system, get more intricate.

The way out for SOEs

By assigning state owned banks to buy back the capital contributed before by SOEs to banks or finance companies, the government has given a way out to the enterprises.

However, this means that Vietcombank, BIDV, Vietinbank… would have to take on the stakes of finance companies or banks, even if they don’t want to, in case the SOEs cannot find the other suitable partners to transfer stakes.

The government has seemingly got patient about the slow capital withdrawal process. The deadline for the capital withdrawal, 2015, is nearing, but PetroVietnam, the Electricity of Vietnam, Vinacomin… still cannot sell their stakes in finance companies and banks.

PetroVietnam, for example, now still holds 20 percent of Ocean Bank’s stakes and 52 percent of PVcombank’s stakes. It needs to sell out the 20 percent of stakes in Ocean Bank and reduce the ownership ratio in PVcombank to below 20 percent by 2015.

EVN could only sell 25.2 million An Binh bank’s shares in late 2013 after three auctions were organized. One of the biggest difficulties for EVN was that it could not sell stakes to foreign investors, because the foreign ownership ratio in An Binh bank hit the ceiling.

Now with the Resolution No. 15, EVN now can offer to sell the stakes to the four state owned commercial banks. Vietcombank, a big partner of EVN, could be the potential buyer.

Banks would suffer?

Dr. Nguyen Tri Hieu, a banking expert, has expressed his worry that the new regulation would make the cross-ownership in the banking sector more intricate.

In the case of EVN, if An Binh Bank now holds the stakes of one or four state owned banks, EVN will not be able to sell An Binh’s stakes to the four banks, in accordance to the current laws.

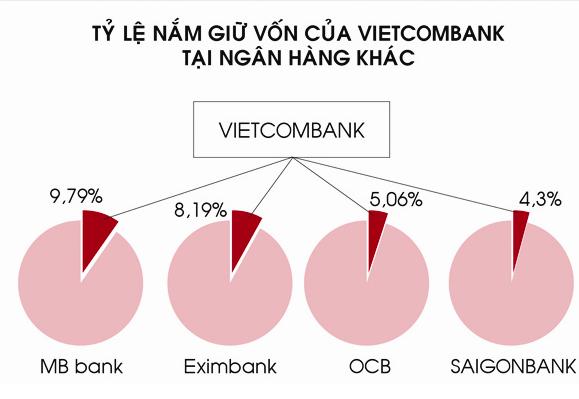

Thoi bai Kinh Doanh has quoted its sources that some state owned banks now hold the stakes of one or many other commercial banks and finance companies already. Vietcombank, for example, has contributed capital to five banks and finance companies.

vietnamnet